- What is Business as Usual (BAU)? - October 8, 2025

- How Slack Grew to 10M Users Without Ads: Complete Growth Blueprint - October 8, 2025

- Top Startups in Kerala 2025 - September 26, 2025

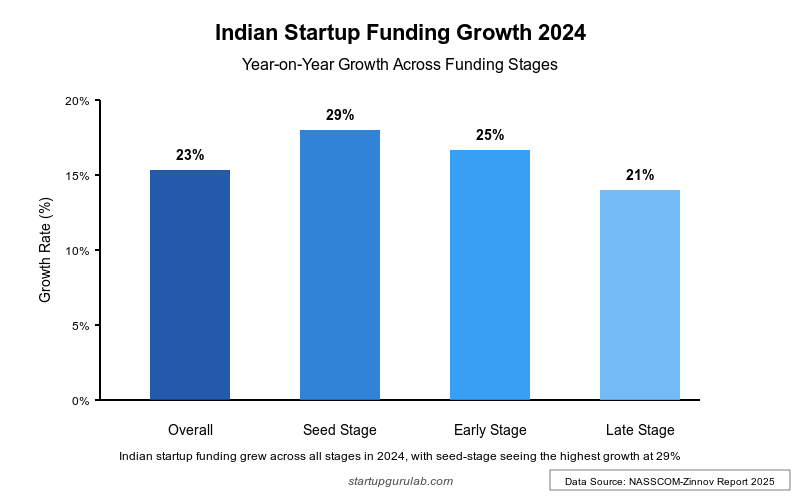

The Indian startup ecosystem has demonstrated remarkable resilience, achieving a 23% year-over-year funding growth in 2024, a period when global markets faced significant economic headwinds. This comprehensive analysis examines the factors driving this impressive recovery, the sectors leading the charge, and what investors and founders can expect in the coming months.

Key Stats

- Total funding: USD 7.4 billion in 2024, a 23% increase from 2023

- Active tech startups: 32,000-35,000+, with 2,000+ new startups founded in 2024 (2.1x growth)

- Deal volume: Increased by 27% with 1,000+ funding deals in 2024

- Seed-stage investments: Grew by 29% in 2024, the highest among all funding stages

- DeepTech funding: Surged by 78% in 2024, with AI capturing 87% of this investment

- Tech startup IPOs: Grew 3x in 2024 compared to 2023

- Profitability: 80% of founders reported increased profitability in 2024 (25 percentage point increase)

- Geographic diversity: 44% of new startups in 2024 emerged from Tier-II and Tier-III cities

- Future outlook: 75% of founders optimistic about increased investments in 2025

Indian Tech Startup Funding Growth

The latest NASSCOM-Zinnov report published in April 2025, reveals a significant rebound in India’s tech startup landscape during 2024. Total funding reached USD 7.4 billion, marking a substantial increase from 2023 figures. This growth comes at a time when many global startup ecosystems continue to struggle with investor caution and tightening capital markets.

Deal Volume Increases Across All Stages

The recovery isn’t limited to funding amounts alone. Deal volume jumped by 27% year-over-year in 2024, with over 1,000 funding deals completed. This indicates broader investor confidence rather than just a few large outlier investments skewing the numbers.

The distribution across funding stages reveals an interesting pattern:

- Seed-stage investments: Grew by 29% in 2024, the highest among all stages

- Early-stage investments: Rose by 25% in 2024 with a 70% increase in deal numbers

- Late-stage investments: Increased by 21% in 2024, with 45% investments raised by non-unicorns

This balanced growth across all funding stages suggests a healthy pipeline of innovations moving from inception to maturity.

Venture Capital in India: Shifting Priorities and Growing Confidence

The Indian venture capital landscape has evolved significantly in 2024, with a renewed focus on fundamentals rather than pure growth metrics. This shift has led to more sustainable investment approaches and better alignment between investor expectations and startup performance.

Institutional Investor Participation Surges

The ecosystem now boasts over 2,300 unique institutional investors as of 2024, a remarkable 5.5x increase since 2020. Even more encouraging is the growing participation of Indian investors:

- Institutional investor participation grew by 44% overall in 2024

- Indian institutional investor participation increased by 54% in 2024

- 61% of unique institutional investors are venture capital firms

Seed Funding Growth Leads the Recovery

Early-stage capital is often considered the lifeblood of innovation, and India’s robust seed funding growth signals a healthy future pipeline of startups. The 29% growth in seed-stage funding in 2024 represents the highest growth rate across all investment stages.

BFSI (Banking, Financial Services, and Insurance) and EnterpriseTech startups led seed-stage funding in both amount raised and deal count, while Energy & Utilities and HealthTech startups secured record-high seed funding compared to previous years.

Tech Startup Investment Trends: Sectors Leading the Charge

The funding recovery hasn’t been uniform across all sectors. Mature sectors dominated, accounting for 67% of total tech startup funding in 2024.

RetailTech and HealthTech Outperform

RetailTech emerged as a standout performer with 2.7x growth in 2024, while HealthTech grew by 1.2x. Together, these sectors showed combined 2x growth, reflecting investor confidence in their business models and market potential.

DeepTech Funding Surge

Perhaps the most noteworthy trend is the 78% surge in DeepTech startup funding in 2024. AI-driven startups captured 87% of this DeepTech investment, with particular focus on:

- Computer Vision and Hyper-personalization (45% of AI funding)

- Natural Language Processing (19%)

- Automation and Optimization (19%)

- Agentic AI and AI Infrastructure (10%)

“DeepTech Start-ups in EnterpriseTech, BFSI and HealthTech sectors raised more than 50% of DeepTech investments in 2024,” indicating where investors see the most promising applications of these frontier technologies.

Startup Funding Trends: Beyond the Numbers

The qualitative shifts in the ecosystem are equally important as the quantitative growth. The report reveals that 88% of founders increased business revenues in 2024, compared to just 69% in 2023. Even more impressive, 80% reported improved profitability—a 25-percentage point increase from the previous year.

Strategic Adaptation Drives Results

This performance improvement wasn’t accidental. The report identifies specific strategic initiatives that drove growth in 2024:

- 64% of founders focused on cost optimization

- 50% implemented revised Go-To-Market strategies

- 82% pursued strategic partnerships for better market access

- 80% increased focus on DeepTech and product R&D

“This growth was driven by strategic initiatives, with 64% founders focusing on cost optimization and 50% implementing revised Go-To-Market strategies in 2024,” the report states.

Geographic Diversification of Indian Startup Ecosystem

While established startup hubs continue to dominate, a notable shift toward emerging centers is underway. The report finds that 44% of tech startups founded in 2024 are based in emerging hubs, representing a 4% increase from 2023.

DeepTech startup founders tend to focus primarily on established hubs as their base of operations, with 71% choosing these locations compared to 29% opting for emerging hubs in 2024. However, this represents a slight diversification from 2023’s 73%-27% split.

The Outlook for Indian Startup Funding

Looking ahead, the report paints an optimistic picture for continued growth in 2025:

- 75% of founders believe investments will accelerate in 2025, with only 5% expressing pessimism

- 99% of founders expect their revenues to grow in 2025

- 89% anticipate increased profitability in 2025

“As we look ahead, 2025 will be a defining year—one where the focus shifts towards DeepTech commercialization, AI-driven efficiencies, and scaling beyond Tier-I hubs,” the report predicts.

What This Means for Investors and Founders

For investors, the Indian startup ecosystem presents a compelling opportunity in an otherwise cautious global market. The combination of economic growth, business model refinement, and technological innovation creates favorable conditions for capital deployment in 2025.

For Founders:

- Focus on fundamentals: The shift to sustainable business models continues to attract investment

- Leverage DeepTech: Particularly AI, as it remains a primary driver of investor interest

- Consider regional opportunities: Emerging hubs offer less competition and potentially lower costs

- Prioritize profitability: The days of growth at all costs appear to be firmly behind us

For Investors:

- Seed-stage opportunities: The strong growth in early-stage funding suggests potential for outsized returns

- Sector diversification: While RetailTech and HealthTech lead, nascent sectors like EnvironmentTech show promise

- DeepTech focus: Particularly AI-powered solutions that address specific industry challenges

- Regional strategy: Consider dedicated allocation for startups from emerging hubs

Conclusion: A Resilient Ecosystem Poised for Further Growth

The 23% funding growth in 2024 despite global economic challenges underscores the inherent strengths of India’s startup ecosystem. The combination of robust economic fundamentals, technological talent, growing domestic consumption, and supportive policy frameworks has created favorable conditions for continued innovation and investment into 2025 and beyond.

As the ecosystem matures further, the emphasis on sustainable growth models, technological differentiation, and solving real-world problems positions Indian startups favorably on the global stage. For investors willing to look beyond short-term market volatility, the long-term trajectory of India’s startup ecosystem offers compelling opportunities.