- What is Business as Usual (BAU)? - October 8, 2025

- How Slack Grew to 10M Users Without Ads: Complete Growth Blueprint - October 8, 2025

- Top Startups in Kerala 2025 - September 26, 2025

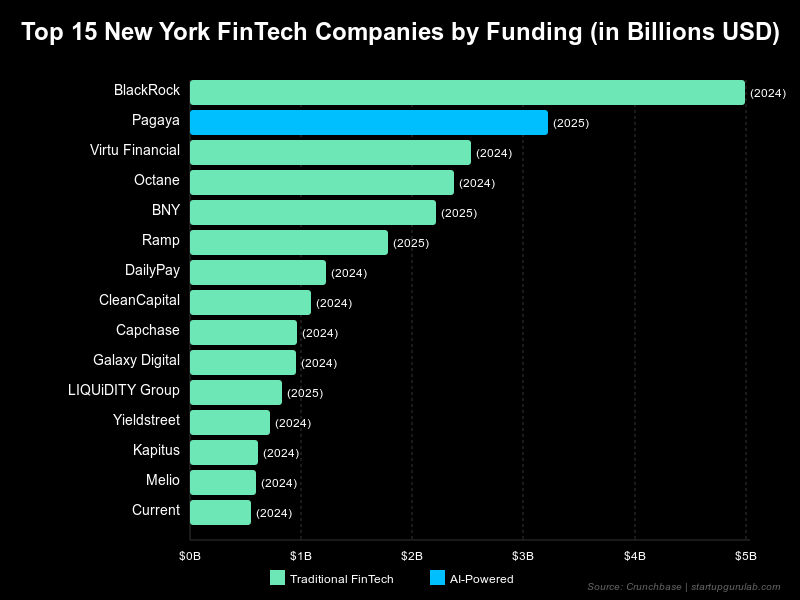

The New York FinTech ecosystem continues to attract massive investment, reinforcing the city’s position as a global financial technology hub. This comprehensive analysis explores the top-funded FinTech companies in New York that received funding between January 2024 and March 2025. While we examine their total accumulated funding, it’s important to note that our dataset specifically focuses on companies with recent funding activity in this 15-month period.

Key Insights

- New York FinTech companies with funding activity in 2024-2025 have a combined total funding of $37.55 billion

- BlackRock leads with $5.51 billion in total accumulated funding, with recent rounds including a $2.5B debt round in July 2024

- Over 33 New York FinTech companies are leveraging artificial intelligence technology

- In the first quarter of 2025 alone, 35 companies secured new funding rounds

Top New York FinTech Companies by Total Funding Amount

1. BlackRock: $5.51 Billion

BlackRock holds the top position with $5.51 billion in total funding, focusing on asset management, crowdfunding, financial services, and real estate investment. Their funding history includes two substantial Post-IPO Debt rounds in 2024 ($2.5B in July and $3B in March), and a Private Equity Round of $13 million in March 2021. As the world’s largest asset manager, BlackRock’s substantial FinTech investments indicate a strategic shift toward technology-driven financial solutions.

2. Pagaya: $3.56 Billion

With $3.56 billion in total funding and their most recent round in February 2025, Pagaya has emerged as the leading AI-powered FinTech company in New York. The company specializes in using artificial intelligence for credit analysis and financial services, demonstrating the growing importance of AI in the financial sector.

3. Virtu Financial: $2.80 Billion

Virtu Financial has accumulated $2.80 billion in funding, with their most recent funding in June 2024. The company focuses on analytics, cryptocurrency, and financial services, providing technology-driven trading solutions that highlight the increasing integration of cryptocurrency capabilities within traditional financial frameworks.

4. Octane: $2.62 Billion

With $2.62 billion in total funding and their most recent round in November 2024, Octane has established itself as a major player in the credit and lending space. The company’s specialized lending platform demonstrates the continued demand for innovative financing solutions in the FinTech landscape.

5. BNY: $2.45 Billion

BNY has secured $2.45 billion in funding, with their latest round in March 2025. Focusing on asset management, banking, finance, and wealth management, this traditional financial institution’s significant FinTech investments highlight the ongoing digital transformation in established financial services.

6. Ramp: $1.97 Billion

With $1.97 billion in total funding and their most recent round in March 2025, Ramp has emerged as a fast-growing expense management and corporate card platform. The company’s success indicates strong market demand for streamlined financial management solutions for businesses.

7. DailyPay: $1.35 Billion

DailyPay has secured $1.35 billion in funding, with their latest round in October 2024. The company is pioneering on-demand pay solutions for workers, demonstrating the expanding scope of FinTech into human resources and payroll management.

8. CleanCapital: $1.21 Billion

With $1.21 billion in funding and their most recent round in December 2024, CleanCapital represents the intersection of FinTech and clean energy investment. This hybrid approach showcases how financial technology is enabling investment in sustainable initiatives.

9. Capchase: $1.07 Billion

Capchase has accumulated $1.07 billion in funding, with their latest round in May 2024. The company specializes in financing for SaaS companies, highlighting the growing need for specialized financial solutions in the technology sector.

10. Galaxy Digital: $1.05 Billion

With $1.05 billion in total funding and their most recent round in November 2024, Galaxy Digital has established itself as a major player in the crypto-finance ecosystem. The company’s investments in asset management, banking, and cryptocurrency demonstrate the mainstreaming of digital assets in financial services.

Emerging FinTech Companies

The remaining top-funded companies include:

- LIQUiDITY Group: $914 million

- Yieldstreet: $795 million

- Kapitus: $675 million

- Melio: $654 million

- Current: $602 million

New York FinTech Funding Trends (2024-2025)

The analysis of our dataset reveals several significant trends:

Recent Funding Activity

Our dataset specifically includes companies with funding activity in 2024-2025:

- 2024: 182 companies received funding in 2024

- 2025 (through March): 35 companies have secured funding in Q1 2025

While we report total accumulated funding for each company, our analysis focuses exclusively on FinTech companies active in the funding market during this 15-month period (January 2024 through March 2025).

AI-Powered FinTech: The Next Frontier

Artificial intelligence is emerging as a critical differentiator in the New York FinTech landscape. Among the 33 AI-focused companies, several standouts include:

Pagaya: Leading the AI Revolution

With $3.56 billion in total funding, Pagaya has established itself as the premier AI-powered FinTech company in New York. The company’s success highlights the transformative potential of artificial intelligence in financial services.

Other Notable AI FinTech Companies

- FundGuard: $156 million (AI for investment management)

- Gynger: $141.7 million (AI for billing and payments)

- Fundraise Up: $82.1 million (AI for nonprofit fundraising)

- Kasisto: $81.45 million (Conversational AI for financial services)

These companies demonstrate the diverse applications of AI within the financial sector, from investment management to customer service.

Strategic Implications for the New York FinTech Ecosystem

The funding data reveals several important strategic implications:

1. Diversification of Financial Services

While traditional financial services remain dominant, substantial investment in AI, cryptocurrency, and blockchain indicates an evolving landscape with multiple growth vectors.

2. AI as a Competitive Advantage

The significant funding for AI-powered financial solutions suggests investors see artificial intelligence as a major growth driver. Companies integrating AI capabilities are attracting premium valuations.

3. Cryptocurrency Mainstreaming

The presence of multiple well-funded cryptocurrency companies demonstrates New York’s position as a hub for regulated cryptocurrency innovation, despite regulatory challenges.

4. Continued Investment Momentum

With 35 companies already securing funding in early 2025, there’s clear evidence of sustained investor confidence in New York’s FinTech sector. These recent investments suggest continued growth throughout the year as the ecosystem matures.

The Future of New York FinTech

Looking ahead, several trends are likely to shape the New York FinTech landscape:

Integration of AI and Blockchain

Companies that successfully integrate AI capabilities with blockchain technology may unlock new financial use cases and attract significant investment.

Regulatory Technology (RegTech)

As financial regulations evolve, RegTech solutions that help companies navigate compliance requirements are likely to see increased demand and funding.

Sustainable Finance

Following CleanCapital’s example, we may see more FinTech companies focusing on enabling sustainable investments and ESG (Environmental, Social, and Governance) initiatives.

Cross-Industry Partnerships

FinTech companies are increasingly partnering with players in other industries, creating new opportunities for financial innovation beyond traditional boundaries.

Conclusion

The New York FinTech ecosystem demonstrates remarkable resilience and innovation. Our analysis of 217 companies that received funding between January 2024 and March 2025 shows a combined total of $37.55 billion in accumulated funding. Led by established players like BlackRock and AI innovators like Pagaya, the sector continues to evolve and expand.

As artificial intelligence, blockchain, and cryptocurrency technologies mature, we can expect continued transformation of the financial services landscape. New York’s position as a global financial hub, combined with its vibrant technology ecosystem, positions the city at the forefront of this financial revolution.

Note: Data for this analysis was sourced from Crunchbase, with company information as of March 26, 2025. Our dataset specifically includes New York FinTech companies that received funding between January 2024 and March 2025. The “Total Funding Amount” represents each company’s lifetime accumulated funding as of their most recent round, not just the funding received during 2024-2025. Our analysis focuses on companies active in the funding market during this 15-month period, ranked by their total accumulated funding as reported by Crunchbase.